Stamp Duty Changes from April 2025 - What You Need to Know!

As UK newspaper headlines cover the US Election while the UK government blurts out seemingly random policies by the day, some of the fine print of last week’s budget may have gone unnoticed.

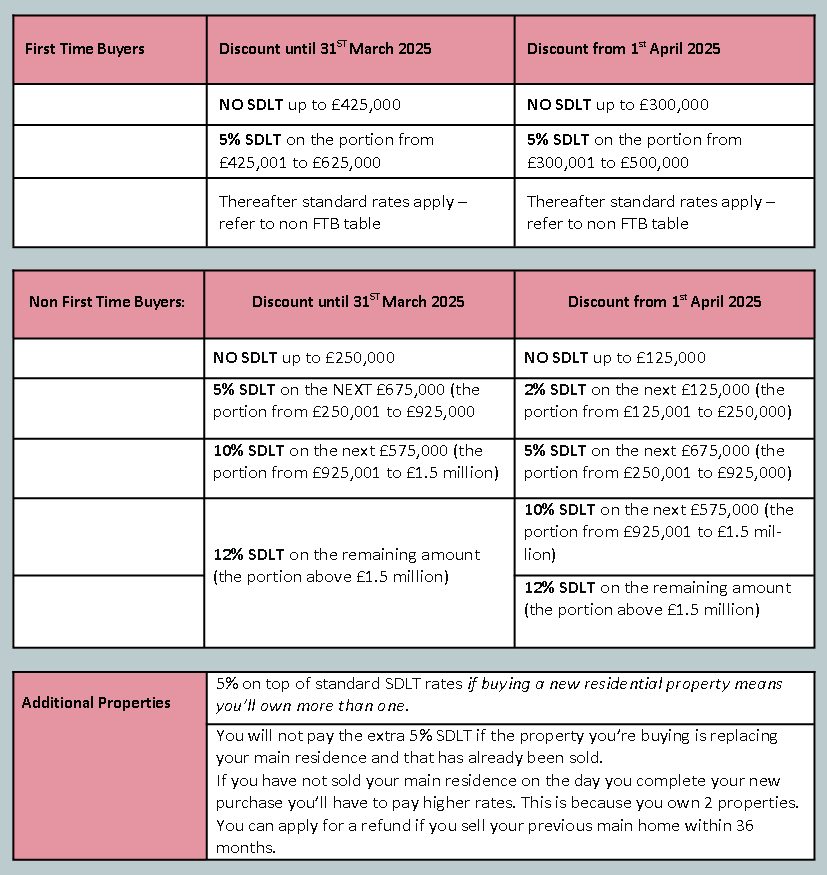

In particular the changes to Stamp Duty, or Stamp Duty Land Tax (SDLT) to give it is full name, to be clear, changes to the stamp duty brackets in 2022 were just a temporary holiday to help ignite the market post Covid, but given that the changes will affect everyone looking to sell or buy a home in the next year Turners Estate Agents, Morden, wanted to outline what it might mean for you when selling or buying your home over the next few months.

Firstly, let’s set out the changes with some tables that we hope, explain it easily.

So what do the Stamp Duty changes above mean, and how does it affect you buying or selling property in the Morden area?

Well primarily if you are wondering whether to sell now or in the New Year, consider that right now buyers will be out in force wanting to beat the stamp duty changes. And given that the conveyancing process can take around 12 -16 weeks on average, both buyers and sellers need to act now to exchange and complete prior to 31st March 2025.

The other factor is of course interest rates which, at the time of writing (Tues 5th Nov), are expected to fall further making mortgages cheaper; but it is the upfront costs of stamp duty that will see first time buyers having to save even more to make that first purchase.

Key points:

-

All Buyers at every level are affected by the SDLT changes

-

To avoid increased SDLT charges you will need to have exchanged and completed on your purchase by March 31st 2025.

-

Additional properties are already subjected to the increased charges.

-

SDLT is an upfront cost meaning FTB’s need to have saved more

-

In Morden where prices average £5000-550k for a 2-3 bed house buyers could save over £6000!

The reality is, whatever the market does, only you know when the time is right to move home, but Turners do want to help make your move easier by letting you know the factors that may influence that decision, so we hope the above tables are helpful.

If you would like an up to date valuation of your property why not contact Robert Davies, Turners Director? He can provide a no obligation, desktop and 1-2-1 in person valuations completely free of charge so that you can be fully armed with all you need to know when making your next move.