Three diagrams showing you if house prices are up or down in Morden right now

If you have read any property related news article lately then you will have been greeted with headlines like:

House prices rose by 4.7% in 2024, says Nationwide

UK housing market ‘starts new year with a bang’, says Rightmove

Hurrah!

UK debt market sell-off threatens to push up mortgage costs

Property sellers in England and Wales ‘make lowest return in a decade’

Boo!

Wait, hang on, they can't all be right can they?

Well yes actually.

Because all of the articles and data used refer to national averages and all of them have to take into account that 2022 saw a huge peak in the property market, but that doesn't tell you what is happening with property prices in Morden right now, but the following diagrams do.

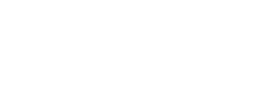

Diagram 1 shows interest rates and how they have risen since 2022 and what level they are as of Jan 2025.

Note that as of February 2025 the interest rate was reduced to 4.5%

What does this mean?

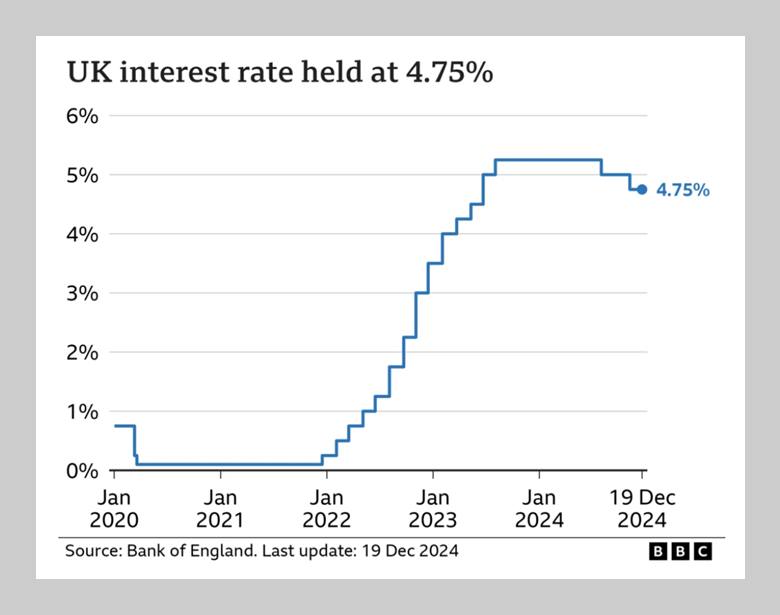

Well, with nearly 700,000 people due to remortage in 2025 and over half a million having been on five year fixed rate deals, current interest rates will severly affect their montlhy outgoings as shown in Diagram 2

As you can see, on a typical St Helier House in Morden priced at £550,000, there is an increase of £750 on monthly mortgage repayments; which, for most people purchasing at this level, would seriously impact on their household spending.

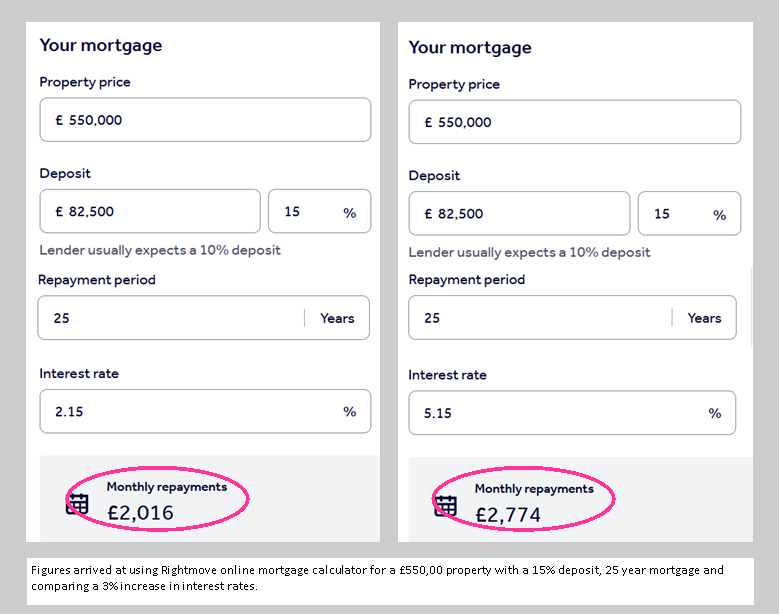

But as a seller, maybe you're not too worried about that and instead want to know if any of the above affects your property value, well diagram 3 indicates why sellers need to keep their expectations in check...

That is not to say all houses are immediately worth less and that all buyers should offer 10k less or that all sellers should despair! But, with a high number of properties coming to market since boxing day, and stamp duty increases due in April we are very much entering a buyers market, with affordability and value for money being at the top of many buyers list.

At Turners, our advice has been as always, price your property realistically to avoid being left on the shelf and it will sell. Price your property based on what 'the bloke told you down the pub', and you may find your property remaining unsold!